The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Six things behavioral economics teaches us about LTC insurance

As a college student I was taught about the wonders of a classical market economy comprised of competing companies selling to rational consumers. My economics professors focused on things such as supply and demand graphs and price elasticity. After college, I spent my early years in LTC Insurance assuming most people made smart decisions about buying coverage.

I was wrong in my assumption. Only about 8% of people fit a classic "planner" profile and have the ability to plan for the future and take action - and not surprisingly, 8% is about the percentage of people who own policies! For the other 92% of us, the traditional ways to talking about planning for LTC aren't working.

The answer might be in the evolving area of behavioral economics. Although I never took college courses on the subject, I'm trying to catch up on the subject because I believe the implications for the future long-term care insurance planning are huge.

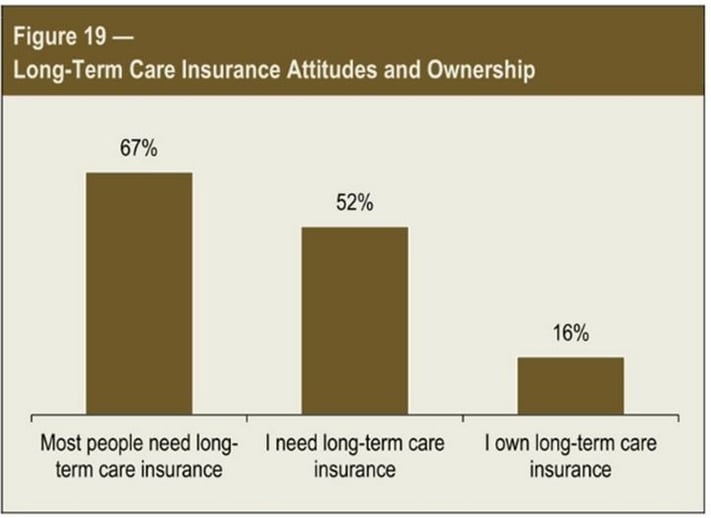

What is behavioral economics? It combines psychology and economic decision making. Best selling books such as Nudge by Richard Thaler describe some of the subjects surprising findings, such as the problems people have saving money for retirement. Consider the image above, which shows the LIMRA and Lifehappens recent 2016 Insurance and Barometer Study. It's obvious people know they need LTC Insurance, but only a fraction own coverage (and that self-reported number is higher than reality).

Companies and governments have recently used the findings of behavioral economics to try and "nudge" people to take actions. For example, more companies now auto-enroll employees in 401(k) plans and make them opt-out if they don't want to join. The result has been a big increase in 401(k) participation. Another finding, that more choices lead to inaction, - has led to the narrowing investment options. Finally, "default" choices, such as target date funds, are now part of many 401(k) plans.

It's time to bring some of these behavioral economics findings to LTC Insurance. Here are six areas in which planning can be improved on:

- Keeping choices as simple as possible. As an advisor, you may think your job is to give a possible buyer multiple options for planning for care, such as spread sheeting several insurance carriers or comparing standalone and linked products. However, the reality is consumers don't want this - they want a recommendation with just a few choices. Limit the options they can consider.

- Focus on the possible gain LTC will provide instead of the possible loss. Gamblers fell worse about losses than good about wins. Likewise, people who are considering LTC Insurance don't want to think about loss when planning for care, such as how their retirement savings may be depleted. Instead, try and focus on the fact that a small LTC Insurance premium gives the policyholder the possibility of a BIG payoff in benefits. For example, a $2,000 annual premium could result in $300,000 to pay for high-quality care ah at home.

- Use stories, not statistics! Statistics are important for discovering trends and insights, but they are awful when used for discussing LTC planning. Statistics destroy empathy and emotion. People are way too optimistic about their future and think they will be on the winning side of a statistic. Focus on stories and experience when talking about planning for LTC.

- Focus on now benefits, not the future. It's incredibly hard for people to imagine aging and needing help. Only something like an aging suit can really give people a glimpse of how needing care will affect them and their families. Instead, focus on the "now" benefits of LTC Insurance. The now benefits for LTC Insurance are harder to quantify, but they can include peace of mind, good health underwriting, and locking into a lower premium before a birthday.

- Help Guide Heuristics (rules of thumb). For analytical advisors, it's tempting to use tools such as cost of care surveys that project the cost of care 40 years in the future when designing plans. A better approach is to "follow the crowd" and recommend benefits similar to what policyholders are actually buying. You may think that people want customized solutions, but most would feel more comfortable picking options similar to other buyers. Recommend they do what most people are doing.

- Force a choice. When people have to make a decision, such as actively signing off the fact they have been offered LTC insurance but declined, they will be more likely to buy. LTC planning is easy to delay, and people don't want to be told they can't delay that decision forever.

Behavioral economics is a controversial subject. Using psychology can seem manipulative, and limiting choices can be seen as part of a nanny-state plot. We'd like to think we all our capable of making rational decisions that are good for us, such as planning for care. The reality may be different.