The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Why single pay LTC Insurance might be the right strategy now

The recent stock market run (especially in tech stocks) has been amazing. Despite the high unemployment rate many investors are enjoying that feeling of increased net worth in both their qualified and non-qualified money.

At the same time many may feel concerns about the market valuations, not to mention the recent craziness around retail investor trading. Are we set for a repeat of big market corrections of 1999 or 2008? Is it time to take some chips off the table and reallocate assets?

Americans have seen the impact the pandemic has had on long-term care facilities and want a flexible plan for care. One great option may be a single premium long-term care insurance plan.

Single premium LTC Insurance plans are just that - an applicant pays a single premium and they are done paying premiums on that policy. Single premium LTC polices are available for both traditional LTC policies and LTC + Life Hybrid plans. Carriers for single premium LTC + Life products include OneAmerica, Nationwide, Lincoln Financial, Securian, and Brighthouse Financial. The carrier that offers single premium in the traditional market is National Guardian Life.

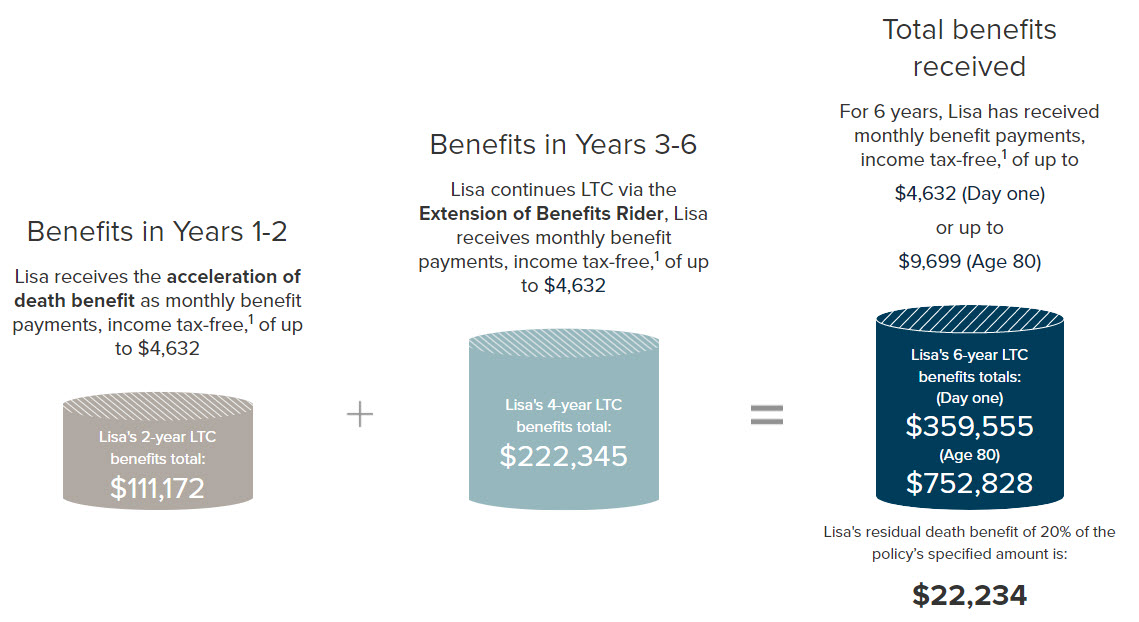

Let's look at how a typical policy works. Consider a 55 year old married female who makes a one time payment of $105,000. The policy she is buying pays a cash benefit for LTC at home, assisted living or in a nursing home and the benefit increases 3% each year.

In this example by age 80 someone has policy that will pay a benefit of almost $10K per month with total benefit available of $752,000. And that benefit is certain, not dependent on market performance unlike "self-insuring".

Consider the advantages of buying a single premium LTC Insurance policy:

- No possibility of future rate increases

- No lapsing of coverage because of not paying premium, whether due to a change in economic circumstances or forgetting.

- The ability to include inflation protection so that benefits will automatically increase with certainty.

- The addition of a death benefit, either through a stated death benefit with Hybrid policies or a return of premium upon death for traditional LTC.

- The ability to get money back due to the product surrender value or premiums paid.

And some of the disadvantages of single premium LTC coverage:

- You need to have the money available.

- Opportunity Cost! That money can't be invested in other investments like stocks (or Bitcoin).

- Cash surrender value - Many plans offer a 100% return of entire premium option, but electing this reduces the LTC benefit.

- No potential annual tax deductions as a business owner or HSA account holder

How does a single premium policy compare to a annual pay plan in terms of premium savings? Let's look at our 55 year old female, who is in excellent health and interested in an initial monthly long-term care benefit of $4,500 per month, an initial benefit of $216,000 ( represents about 4 years of care) growing at 3% compound based on an included inflation rider. At age 90, this would result in an approximate monthly benefit of $12,293/month and a total benefit pool of $590,000. Again, that benefit is defined and specific - not subject to market fluctuations.

The graph below shows actual carrier premiums as of February 3, 2021:

| Carrier | Single Premium option | Annual Premium option | Total annual premium payments to age 90 | Savings from single premium (at age 90) |

| Hybrid LTC Policy 1 | $101,910 | $6,856 | $239,960 | $138,050 |

| Hybrid LTC Policy 2 | $113,805 | $6,843 | $239,505 | $125,700 |

| Traditional LTC Policy | $83,057 | $3,360 | $117,600 | $ 34,543 |

The savings above don't reflect a couple of important items. The first was mentioned above - the opportunity cost of the single premium. Secondly, there many be annual tax deductions available from the annual premium products. Also, those who need care earlier may benefit financially because many annual pay plans offer waiver of premium upon going on claim.

Once a single premium plan has be purchased, it should give an investor more confidence to invest their money, knowing that the LTC benefit will be there.

There are many sources of to fund a single premium LTC policy. Here are some of them:

1) Cash. No Bitcoin accepted currently :-)

2) Non-qualified investments. This may trigger short or long term tax implications and this needs to be considered.

3) Retiring Certificates of Deposits

4) A 1035 tax-free exchange of an existing life insurance policy that has cash value but not LTC Insurance benefits

5) Qualified Money, such as from a 401(k)

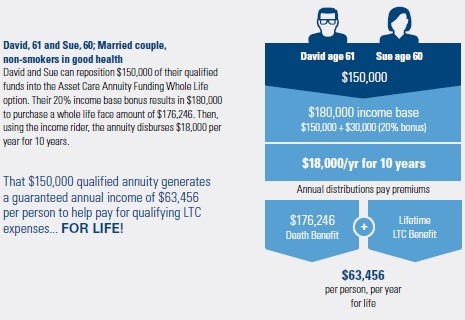

Importantly, withdrawing qualified money to pay the premium will result in ordinary income tax treatment. That's why carriers have designed solutions that allow the qualified funds to purchase an annuity that will in turn fund a 10-pay LTC Insurance policy- spreading the tax hit over several years. An example below from a carrier shows their policy for doing this. In essence, $150,000 of these clients qualified dollars can result in a lifetime benefit LTC Insurance policy.

What about clients who are still skeptical about LTC Insurance and want to have the flexibility of getting their money back?

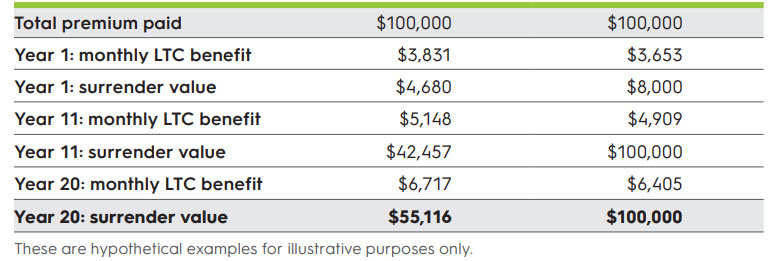

Let's consider two different LTC Insurance products for a 55 year old female. The first product on the left is geared for maximizing the LTC Insurance benefit. The product in the right column, on the other hand, allows for 100% return of premium (after 5 years of the policy being in force).

In this example the opportunity cost for five years in our low interest rate environment is pretty low. The client could get their money back and reinvest however they would like.

In reality, however, very few purchasers of single premium LTC + Life Insurance policies elect to get their premium returned or dip into the cash value. Instead, these are smart people who understand the leverage that good health combined with LTC Insurance can provide.

Single premium LTC plans can help fund a plan for care and provide peace of mind for a family - well worth considering.