The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

How to easily explain linked benefit LTC insurance products

Most Americans are not long-term care insurance experts. This shouldn't surprise anyone who has the challenging task of convincing people to plan for long-term care when they would rather be doing just about anything else.

Because talking about long-term care is so challenging, it's critical to take the time to explain the different options for planning, including linked life/ltc plans. Since linked plans combine both life insurance and LTC insurance there can be a perception they are complicated. However, that's not the case.

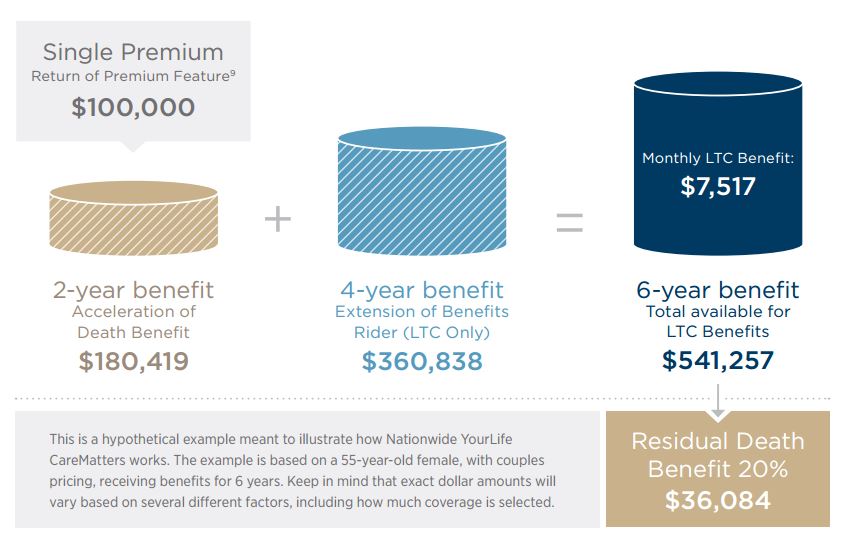

Consider this example from Nationwide:

You'll notice that by working from the upper left hand corner of the image and discussing the single premium first there is simple flow to the story.

First, the $100,000 deposit creates a $180,419 life insurance policy that will pay upon death, unless LTC is needed. If long-term care is needed the money will first come from the acceleration of the death benefit, than from an extension of benefits rider. Finally, if the policy holder changes their mind prior to a LTC need they can get their money back.

LTCI Partners hosted a webinar with two leading linked product experts, Gary Munz from OneAmerica and Jason Combs from Nationwide. They gave some great tips on simplifying the linked-product conversation and explained what attracted clients to the products. The entire webinar can be found here, but here are some ideas they shared:

- Stay away from statistics - In Jason's experience "discussing the odds of needing care will lead to the client thinking they will be one of the lucky ones". Instead, get agreement that if a care event did happen the impact on the family would be severe.

- Guarantees - Consumers like the guarantees and certainty found in linked products. A complaint of people who bought standalone coverage has been in-force premium increases due to under priced products.

- Reallocation of money - Gary from OneAmerica likes to ask "in the absence of long-term care insurance, which asset would you liquidate first to pay for care?". That asset, such as a bank CD, can end up being a great funding source for single premium life/ltc plans.

- Stick with popular options. Don't get fancy with plan designs. According to Jason, "the majority of sales are single premiums, an average initial deposit of $80,000, and a six year benefit with no inflation". See the example above.

Are there any risks with life/ltc plans? The main dowside is interest rate risk. If interest rates increase the opportunity cost of having a lot of money tied up in a single premium can be high. The single premium shouldn't represent a larger percentage of the policyholders total net worth.

Once the basic concept of single premium is explained and understood by a potential buyer more options can be explored. First, however, keep it simple!