The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Why its worth your client's time to buy LTC Insurance

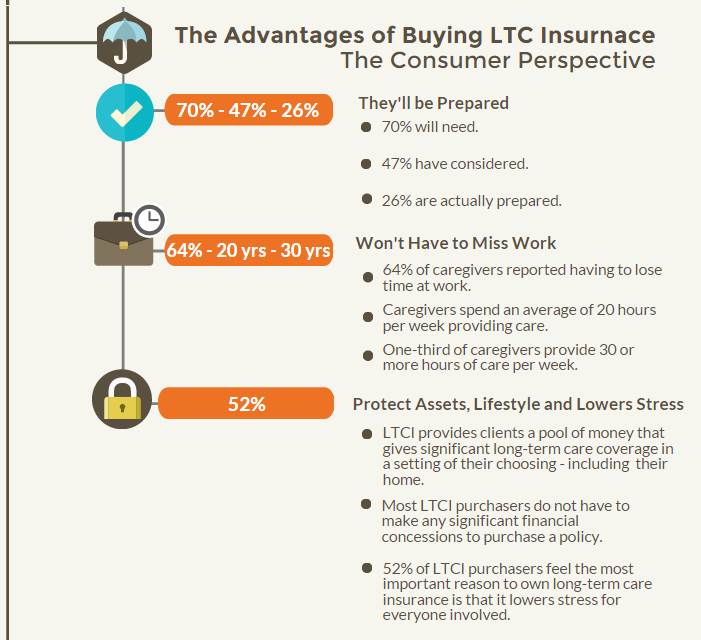

Last week we discussed why it's worth it for an advisor to sell LTC Insurance. This week we want to look at the consumers perspective - and why it's worth their time in buying LTC Insurance.

Based on sales trends, buying long-term care insurance has not been on the top of peoples to-do lists. The reasons have been well documented, but a primary one is the buying process can be a hassle. From long applications and intensive underwriting, LTC Insurance is an easy purchase to delay.

This doesn't mean people aren't aware of the need to plan. They are concerned and believe it is their, not the governments, responsibility to plan for their own care.A recent Health and Human Services study of over 15,000 Americans aged 40-70 concludes the following: "In general, and when responding to the survey questionnaire, respondents favored individual responsibility over government responsibility for LTC financing. Moreover, respondents generally favored voluntary initiatives, both private and public, although they had a stronger preference for private LTC insurance."

Once people do purchase they benefit in several ways, including:

- Piece of mind that they've reduced the impact on their family if something happens to them

- Ability to access care through home and assisted living facilities while avoiding Medicaid nursing homes

- More flexibility in investing money for retirement

- Ability to talk to children about their plans for care in the future since it will be funded

For more reasons, check out the infographic below that shows additional advantages for consumers. LTC Planning can be accomplished - with a sense of urgency and purpose from both the advisor and client.

Want to remove the hassle?