The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Should you always recommend LTC Insurance with automatic inflation?

For many years, the question of whether to add automatic inflation coverage to LTC Insurance was a no-brainer. Traditional LTC policies were less expensive back then, and adding 5% compound inflation didn't impact affordability for most clients.

Now, however, the answer is not so simple, and advisors should consider whether simply buying more coverage up front is a better strategy, especially for couples age 55+. We've looked at this topic before, and wanted to update the numbers for today's product.

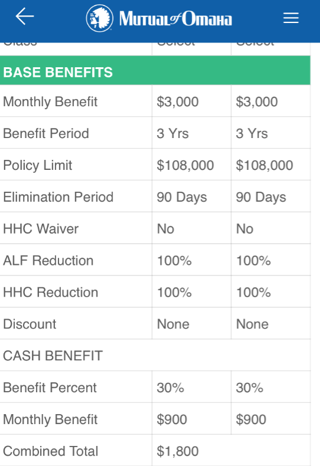

Consider a 60 year old couple who have a premium budget of $3,000 per year and are considering a shared care standalone LTCI policy. Let's compare two quotes, one with 3% inflation and one with no inflation. I ran quotes from Mutual of Omaha using their mobile software. This software is easy to use and automatically updates with the latest rates.

First, the plan with 3% compound inflation.

As you can see, the couple gets a combined pool of money of $216,000 and an initial benefit of $3,000 each. Benefits will grow at 3% compound inflation, and the policy should be eligible as a "partnership" policy in most states.

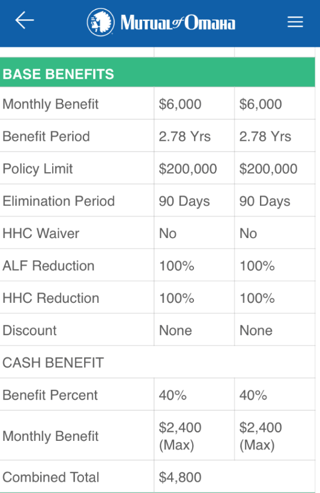

Next, the plan with no inflation coverage:

Here, the benefits are a combined $400,000 and the monthly benefit is $6,000 each. In most states, this plan will not be "partnership" eligible.

As you can see someone gets about double the initial benefit with the "no inflation" plan. Looking to the future, it takes about 23 years for a 3% inflation plan to catch up with the no-inflation plan. Actuaries have to reserve for these ever increasing benefit amounts, and that is expensive.

Which plan is best? It depends on what happens in the future, of course! Let's look at some scenarios:

-

Both clients live a really healthy, really really long life. If this couple has no health problems until age 95, and then someone needs care, choosing the inflation benefit would have been a good call. The combined monthly benefit would be about $600,000 and the monthly benefit each would be about $8,200 per month.

-

One client needs care, exhausts their LTC benefit pool and their assets, and also have a low income allowing them to qualify for Medicaid. In this hypothetical case, the partnership protection of plans with inflation can be accessed. As interesting as these plans have been, the number of policyholders who bought policies and then end up on Medicaid is rare. As an example, Connecticut has sold a partnership plan in the state since the 90's and over 60,000 have bought these plans. To date, the number of people who have these plans in place and qualified for Medicaid (thus preserving their assets) is 204. The state estimates it has saved under $30 million in Medicaid savings due to the program, a mere drop in the ocean of long-term care spending. (As a side note, many states have minimum benefits that must be purchased - a $3,000 monthly benefit may not even qualify for partnership plans, meaning the people that are meant to benefit from these plans can't afford them!)

-

One person has a stroke at age 65 and needs help for 6 months, but then recovers enough so that no longer is benefit eligible. At age 65, the monthly benefit under the "no inflation" option will be $6,000 compared to about $3,400 for the inflation plan - a more significant benefit for payment of ongoing caregiving costs. The no inflation choice would have worked.

-

Someone is diagnosed with aggressive early onset dementia or Alzheimer's. The number one claim cost for LTC for these types of claims, and they can be expensive. Because of that, it would have been better to have purchased the higher benefit "no inflation" coverage.

A few other things to consider:

-

According to the 2017 Milliman/Broker World Long-Term Care Insurance Survey, only about 25% of policies are now bought with either 3% compound or 5% compound automatic inflation coverage.

-

Over half of worksite LTC plans are sold with either no or future purchase option coverage, according the the 2017 Analysis of worksite LTC Insurance. The worksite market is growing at a faster rate than sales in the individual market, and perhaps more affordable premiums are a reason.

-

Carriers are asking regulators whether mandatory inflation options are necessary on LTC coverage. With only 2% of policy buyers selecting 5% compound, should it still be required to be offered?

-

Many hybrid life/ltc plans offer inflation coverage, but often plans are purchased without automatic inflation, especially on the ADB (acceleration of death benefit).

So what do you think? which plan design makes more sense? Add your thoughts below.