The Advisor's View of Long-Term Care Planning

Never miss any update

Subscribe to the Advisor's View of Long-Term Care Planning newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Aug 22, 2022 • Tom Riekse Jr

These two trends signal much higher LTC costs in the future - regardless of inflation

Designing a LTC plan that will have appropriate benefits in 30 or 40 years can be really challenging! Despite that, many older LTC policies have actually done a pretty decent job of keeping up with the cost of long-term care. How do I know? Well, my Mom purchased a LTC Insurance policy from CNA Financial back in 1991. The initial benefit was $100 per day with a 5% automatic inflation increase benefit. Now, she is receiving care in a private room in an excellent nursing facility. The facility charges $420 per day for care, less than the $454 benefit daily benefit of the policy. The policy covers ALL the cost of her care.

Of course, that is an anecdotal example. Some policies have not kept up with the cost of care, especially those without inflation riders. Fortunately, however, many of the dire, scary predictions during the early 90s related to the cost and availability of care haven't come true. Although stressed by the pandemic, there is currently a strong infrastructure of home care, assisted living and skilled nursing facilities. People pay for care using their LTC policies, riders on life policies, or retirement savings.

A possible scary future

Th

But what if in 30 years there were fewer caregivers around, leading to higher and higher costs as people compete for caregivers? (And no Elon, robots won't replace the necessary human touch in caregiving). Will today's plan designs keep up with the cost of care the way older plans have worked today? And if that is the case what strategies should clients use?

First, the immediate top of mind concern is inflation. Each year Genworth Financial conducts a cost of care survey that tracks the cost of care for home and facility care. Their most recent data shows that for 2021 the cost of a home health aide increased a whopping 12.5%! The increase for assisted living facilities was 4.65%. Those increases are higher than the typical 3% compound inflation option that policyholders select.

High inflation is transitory and will eventually settle down. But it is more difficult to see how the relative cost of long-term care will not be higher in the future. Two big trends are leading the way towards this crisis of increasing care costs- demographics and immigration. For many people, this narrative seems counter intuitive. They may see news stories about the border crisis and people flooding over the border. They may live in a neighborhood populated with newborns and toddlers. The facts, however, are more complicated. Let’s look at these trends more in depth.

Demographics

Birth rates in the United States are declining more than expected. Post pandemic, it was expected that Millennials would start having children but that hasn't occurred to the degree expected. Reasons for the delay in starting families include the expense of bringing up kids - things like housing costs, daycare, healthcare, future college, etc. According to Merrill Lynch the cost of raising a child is around $230,000 ( Why the Average Cost of Raising a Child Today Is More Than $230,000 (businessinsider.com) Many young couples also express concerns about climate change and bringing children into a world with an uncertain future.

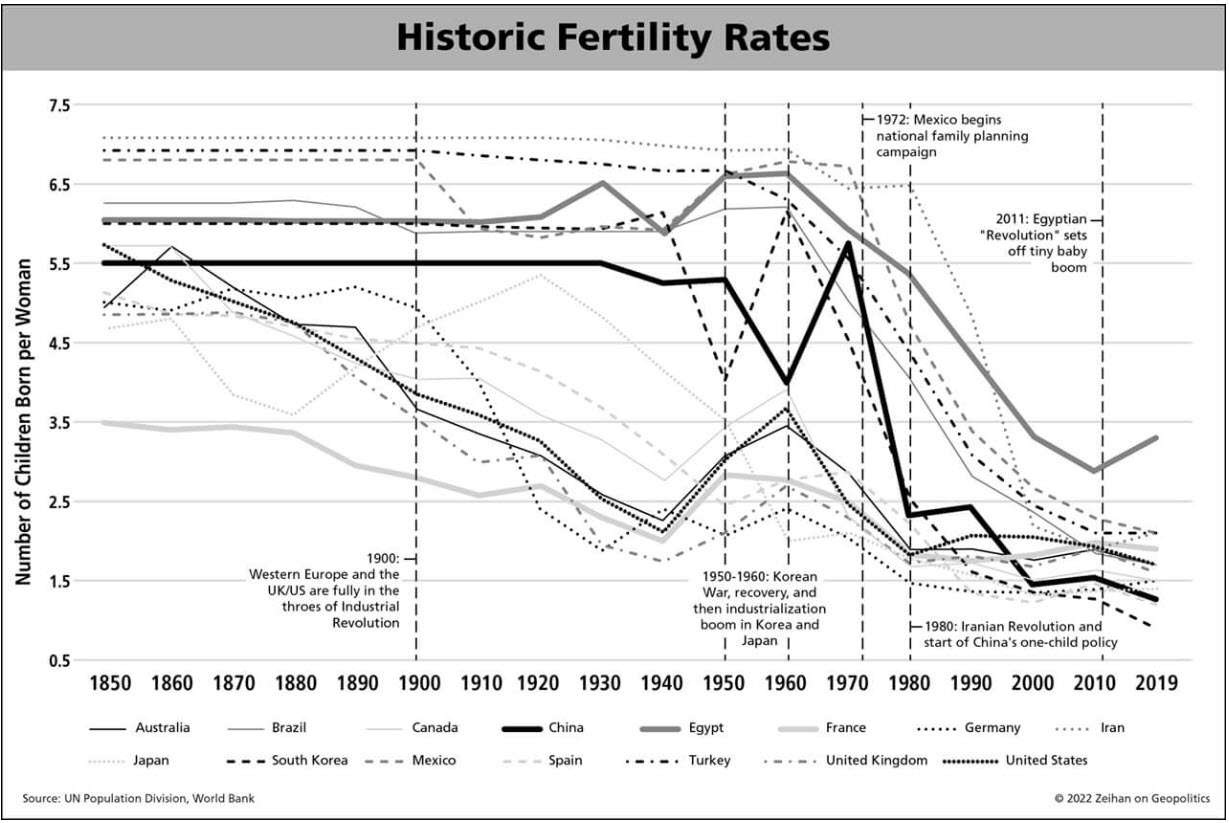

These demographics are not limited to the United States. Check out some other countries and the decline in birth rates:

Of note is the solid black line, which represents China and which will follow Japan with a rapidly aging society and shrinking population. It's understandable why a Chinese company was interested in buying a long-term care insurer like Genworth.

Countries who want to continue to grow their economy will be faced with difficult decisions. Many have tried to encourage citizens to have more children with little success. They may have to instead encourage bringing in people from other countries. Which brings us too....

Immigration

As you can see from the chart above , fertility rates are declining across the board. This means less people in general to feed an immigration pipeline to the US to become caregivers. According to an article in the July 2022 edition of the Economist, net international migration added 247,000 people to America's population from July of 2020 to July of 2021. Although that seems like a lot of people, it is the smallest increase in the last three decades. Covid played a role in the decline, but net immigration has been trending down since 2017 and the process of gaining legal access to the United States is getting more challenging. Regardless of whether you think reduced immigration is a good or bad thing, there is no doubt it will result in fewer people to provide care to aging Americans in the future.

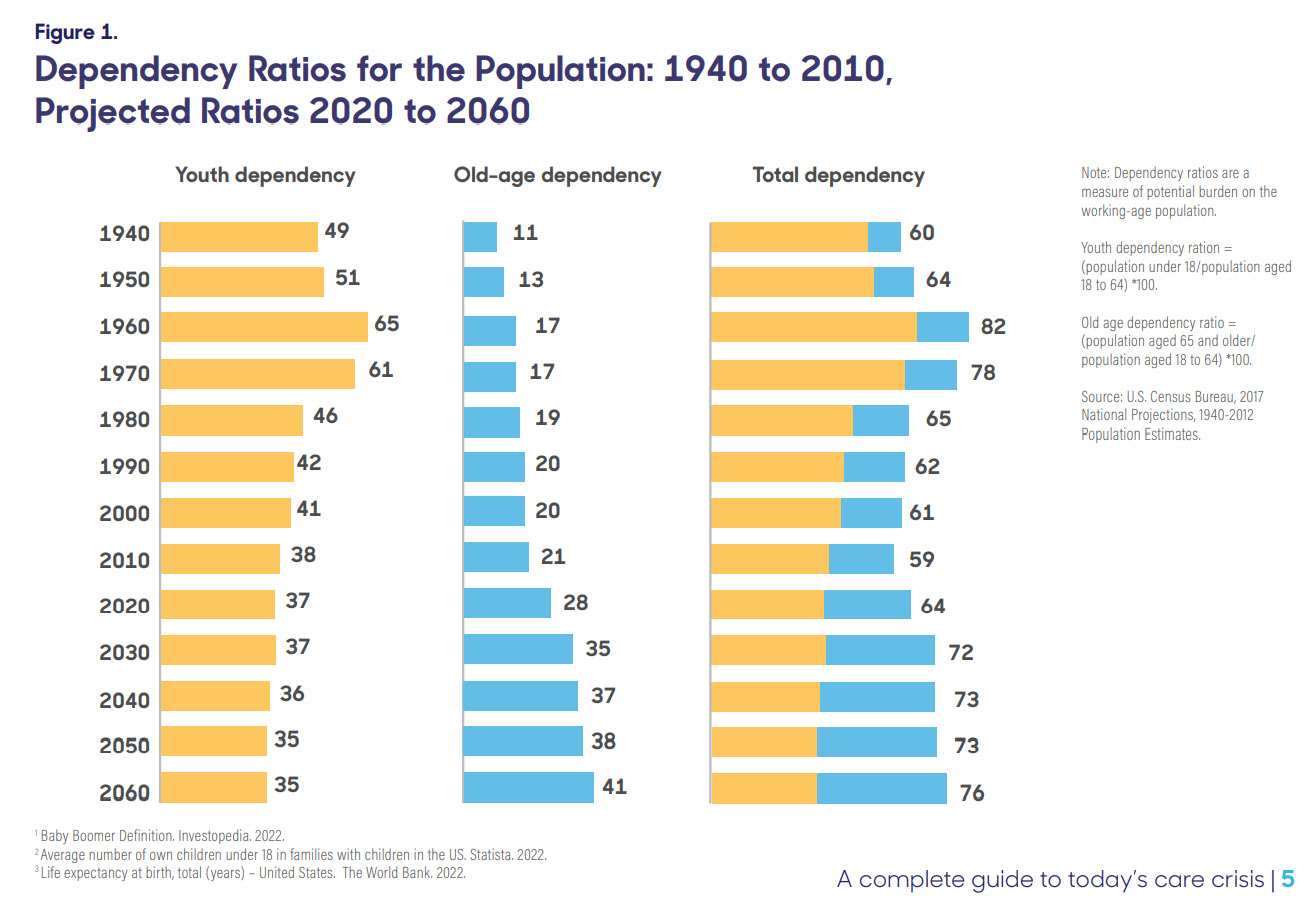

The combination of declining fertility and immigration means the projected old-age dependency ratios will start to rapidly increase. That is the ratio of 65+ population -the population most likely to need care - compared to the number of working age adults from 18-64. Those working age adults who decide to take a career in caregiving will be able to demand much higher wages for their services. Unfortunately, only those with the financial means to compete for their labor costs will be able to afford care.

What are some strategies clients and their advisors can use to deal with this?

1. First time LTC Insurance buyers should consider buying higher benefit amounts or inflation riders. It's easier to reduce benefits if things change in the future than add additional benefits, which would be priced at higher attained age rates and subject to medical underwriting.

2. Policyholders who received in-force premium increases should consider paying the full premium increase. Many carriers offer policyholders the chance to reduce benefits or inflation riders in exchange for a lower premium increase. It's probably advisable in most cases to pay the increased premium cost if it won't cause too much financial pain.

3. For those who can't buy more coverage set aside more retirement savings in safe money investments to pay for care.

Traditionally, "scare tactics" have never been effective in getting people to plan for care - and stories work better than statistics in having a LTC discussion. But understanding some of the big trends in our world can help advisors and their clients better plan for an uncertain future.

Written by Tom Riekse Jr

Tom Riekse, ChFC, CLU, CEBS is the Managing Director of LTCI Partners, one of the largest national distributors focused on long term-care planning. LTCI Partners works with financial advisors, benefit brokers, associations and anyone else interested in helping protect people against the devastating financial impact of a long-term care event.