COVID-19 and underwriting guidelines

We reevaluated and adjusted our underwriting guidelines for applicants who have had a negative COVID-19 test. The current guidelines are:

- If a test is taken:

- There will be no waiting period for negative testing scenarios such as work, travel, visiting family or testing in advance of an elective surgery (colonoscopy, etc.).

- There will be a one month waiting period for a negative test result on an applicant with symptoms or direct exposure to another person who was positive.

- A positive test is a 6 month waiting period after full recovery to assess any residuals.

These guidelines are subject to change as we all continue to learn more about COVID-19, its implications and as treatments/vaccines are developed. We strongly encourage you to prequalify each case with as many details as possible. Thank you for working with us and adjusting throughout this process.

Click here for a quick refresher on NGL's Long Term Care insurance underwriting process.

Reminder - all policies now have copies of schedule pages

You asked and we listened. As a reminder, all issued National Guardian Life Insurance Company (NGL) EssentialLTC policies, including California, will now be accompanied by copies of the schedule pages for your convenience. These copies are intended for you to easily keep a copy of the schedule pages for your own records before you forward the policy to the policyholder.

2021 COLA adjustments for Long Term Care insurance premiums

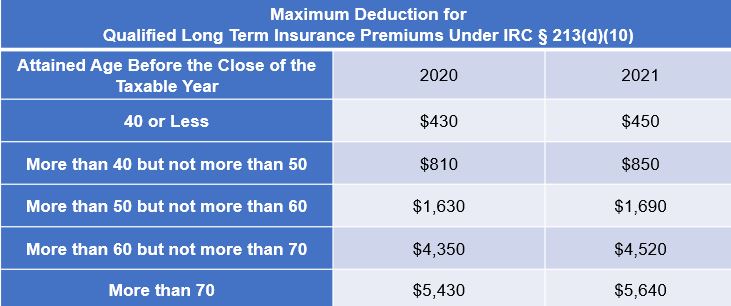

The Internal Revenue Service issued Rev. Proc. 2020-45 providing the 2021 cost of living adjustments (COLAs) for certain items under the Internal Revenue Code (IRC), including "for eligible long term care premiums." The maximum deduction that an individual who itemizes deductions may take for qualified long term care insurance premiums is set under IRC §213(d) and adjusted annual for increases in the medical care cost component of the consumer price index.

The new maximum qualified long term care premium deductions under IRC §213 - for taxable years beginning in 2021 are as follows:

Additionally, Rev. Proc. 2020-45 provides that the stated dollar amount of the per diem limitation under IRC § 7702B(d)(4) is $400 for 2021 (2020 was $380).

Upcoming holiday hours We hope you have a safe and healthy holiday season. Please note these upcoming important dates with special holiday hours for our office: We hope you have a safe and healthy holiday season. Please note these upcoming important dates with special holiday hours for our office:

Thursday, December 24 - Office closes at 1 p.m. PST

Friday, December 25 - Closed

Thursday, December 31 - Office closes at 1 p.m. PST

Friday, January 1 - Closed

Please contact your dedicated Long Term Care Sales Team at LTC@nglic.com with questions.

Thank you.

|

We hope you have a safe and healthy holiday season. Please note these upcoming important dates with special holiday hours for our office:

We hope you have a safe and healthy holiday season. Please note these upcoming important dates with special holiday hours for our office: