Group LTC Benefits Blog

Never miss any update

Subscribe to the Group LTC Benefits blog newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

Group Life Insurance with LTC Benefits (New Planning Options)

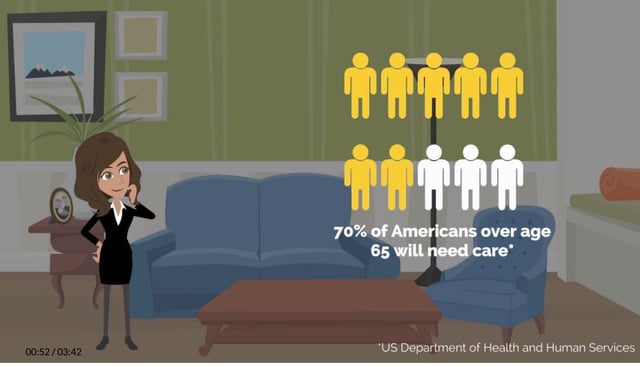

Life Insurance and Long-Term Care? Offered to Groups? YES -- these plans have been growing in popularity and offered in the Individual Insurance market for many years, but are now gaining steam in the Group market too. Why are more benefits brokers and employers implementing these programs?

For a few reasons. First, pure Long-Term Care Insurance has a "use it or lose it" structure that some people don't like. On the other hand, a combination Life/LTC Insurance plan will always pay either a death benefit or a LTC benefit (as long as premiums are being paid).

Another reason that people like these plans is that a younger buyer can be sure their family is protected at an early age while also investing in Long-Term Care protection that may be needed after retirement. For most people, as they age their Life Insurance needs decline (as their children leave the house and become self-sufficient), but their need for Long-Term Care planning grows.

Finally, a major appeal of some of the Life/LTC Insurance plans is premium stability. It's a well-publicized fact that many LTC Insurance carriers are raising premiums for current participants on in-force Group plans. Although current products are priced to avoid future rate increases, it is likely that many potential buyers of Long-Term Care Insurance at the worksite will be concerned about rate increases. Some of the Life/LTC combination products offer guaranteed premiums which will appeal employers and employees.

If you want to learn more about these new options, please call us (877) 949-4582 x7 or email groupltc@ltcipartners.com. Or, check out more information about life/ltc group plans in the Essential Guide to Group LTC Insurance.

%20%232.png)