Consumer Planning Blog

Never miss any update

Subscribe to the Consumer Plannig Blog newsletter today to receive updates on the latest news from our carriers.

Your privacy is important to us. We have developed a Privacy Policy that covers how we collect, use, disclose, transfer, and store your information.

What’s the right age to buy long-term care insurance?

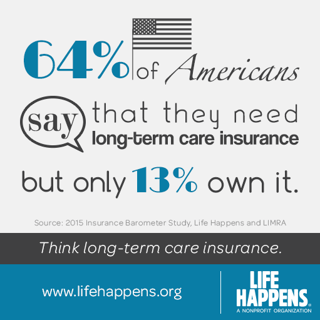

Waiting to think about your plans for long-term care until you or a loved one needs it can often result in additional, unnecessary stress – in an already stressful time - over unexpected costs and coordination of logistics among other concerns. Instead of focusing on the individual, our attention is diverted to research and paperwork.

Waiting to think about your plans for long-term care until you or a loved one needs it can often result in additional, unnecessary stress – in an already stressful time - over unexpected costs and coordination of logistics among other concerns. Instead of focusing on the individual, our attention is diverted to research and paperwork.

So, when is the right time to begin planning and thinking about long-term care insurance? It’s never too early to start doing your homework, but the recommended time to take action is in your mid-50s.

There are two main advantages to being proactive with LTCI planning – the sooner you lock in a policy, the lower your cost in the long run and the likelihood that you will qualify is greater. As you age, the requirements for qualification become stricter. Ultimately, the longer you wait, the more difficult it becomes to get coverage.

The moral of the story is to take advantage of the time you have to prepare for the future. Without a crystal ball, we never know exactly when that future will begin.