Helping client's plan for long-term care - an essential service

Talking about our future health care needs can be scary. It’s hard to think about a time when you might not be able to care for yourself. It’s harder still to determine how long you need to work and how much you’ll need to save to be able to afford care. Today more than ever, we know that things can change quickly, and not being prepared for the unexpected isn’t an option.

Long-Term Care Insurance is an invaluable tool in addressing those emotional and financial fears. In much the same way that Life Insurance provides assurance that our loved ones will be taken care of after we’re gone, LTCI (LTCI) provides assurance that we will be taken care of in the event of a medical crisis or change in cognitive ability.

Quick Links

The Importance of LTCI

The Need for Long-Term Care

Americans have been living longer and longer lives for generations. In 1950, Americans lived to just over 68 years old. Today, the average American man can expect to live to be over 76 years old, while the average woman will surpass 81. With those longer lives comes an increased likelihood of needing extended care, which might not be covered by Health Insurance or Medicare. For example, if you suffer a heart attack, your treatment in the hospital will be covered by Health Insurance. But if you need help with daily activities at home as you recover, you’ll need resources such as LTCI to cover those costs.

Our parents and grandparents likely turned to family to provide this kind of care as they aged. However, Americans aren’t having as many children today as we did in the past. That means for many of us, our family and friends are who we turn to if we need Long-Term Care. And they will likely be at the same stage of life as us.

Are you ready for the good news and bad news of our family structures? Divorce rates are actually declining, but fewer people are getting married. With finances among the primary reasons for waiting or not marrying, some people are opting for unmarried domestic partnerships or putting marriage off until later. It’s clear that Americans today have a flexible approach to family structures, and will need to take Long Term Care planning into their own hands.

Health Is Wealth

As we live longer lives, the chances of our best-laid plans going awry increases. Savings can be depleted, markets can dive, and our most valuable asset — our health — can put an active, happy retirement out of reach.

Maintaining good health is vital to maintaining wealth. For example, one in three Americans has high blood pressure, costing them nearly $2,000 more every year in health care costs compared to people without hypertension.

Long-Term Care Insurance provides assurance that declining health won’t force a decline in wealth.

Long-Term Care and Independence

As the COVID-19 pandemic demonstrates, it’s important to have options. For families with Long-Term Care Insurance, one of the options includes the ability to receive health care in the safety and comfort of their homes. Long-Term Care Insurance provides coverage for Assisted Living Facility costs as well. Simply stated, Long-Term Care Insurance helps people maintain their independence.

Women and Long-Term Care

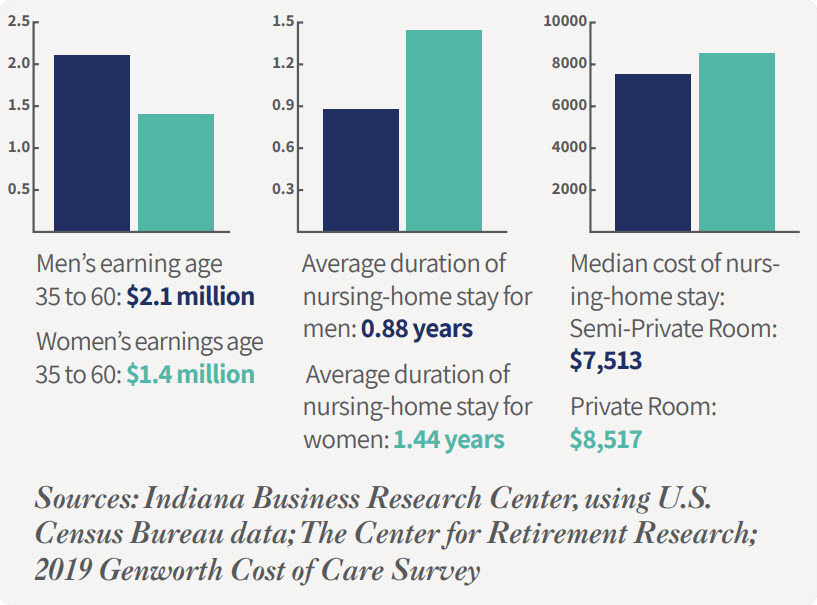

Caregiving often falls to women. More often than men, they are taking time away from their careers to raise children, or are providing unpaid care for aging or sick family members — about 60% of caregivers are women.

Women also typically live longer than their male partners. This puts them in the unusual position of being more likely to be a caregiver, and more likely to need some kind of care in their lifetimes.

For the nearly half of women who will live alone after age 75, having Long-Term Care Insurance can provide reassurance that they will have someone to look after them, if there comes a time when they can’t look after themselves.

Traditional Long-Term Care Insurance

Long-Term Care Insurance has been available for over 30 years, but the product has evolved with consumers’ needs, and changes in the marketplace. Today, there are two basic kinds of LTCI: Traditional and Hybrid Life + LTCI products.

Misconceptions about Traditional LTCI

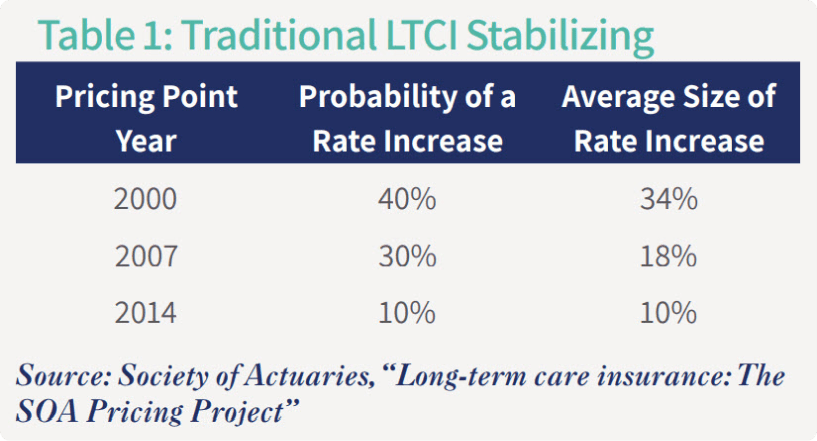

If your only experience with LTCI is from headlines decrying rate increases, you probably don’t have a very positive opinion of the product. In the early days of LTCI, it was hard for insurers and state regulators to determine how much they should charge customers for this kind of protection. That led to many policies being seriously underpriced.

The resulting rate increases continue to attract attention, causing some advisors and consumers to look at these products as risky investments. Those who have LTCI coverage have been frustrated by higher premiums or rate increases, as insurance companies have been making adjustments to their blocks of business. For many who don’t own a policy, surprise rate increases could make their premium unaffordable, and cause them to lose their coverage when they really need it.

As the industry matured, insurers gained a better understanding of pricing needs, and the drastic price changes of early LTCI products leveled off. Table 1 shows how both the probability and the average size of a rate increase have come down dramatically over the years.

Traditional LTCI is Still Valuable

Today, the LTCI landscape is very different from its origin. Premiums have stabilized, and may be 5% to 15% cheaper than other types of Long-Term Care coverage.

For every dollar spent in premiums, claimants received $2.78 in benefits. People who bought their policies after 2007 saw an even greater return. For every premium dollar they paid, claimants received $5.02 in benefits.

LTCI’s progress in policy design and pricing is evident in consumer satisfaction. Nearly 70% of claimants say they are very satisfied with their policy, and 90% are happy with the amount of coverage they purchased.

Typical Plan Designs and Premiums

According to the 2020 Millimen LTC Survey , here are some characteristics of products selling today:

- Average Premium: $2,551

- Average Age of Purchase 57.7

- Average Benefit Period 3.79 years

- Average Monthly Maximum Benefit: $4,882

- 33% of policies have 3% compound inflation

- 91% of policies have 84-100 day Elimination Period

With these averages in mind, here is a comparison of actual premiums for a 57 year old single female, 57 year old single male, and a 57 year old couple who are purchasing a 4 year benefit period, a monthly long-term care benefit of $4,500, and 3% compound inflation. That plan design calculates an initial benefit pool of $216,000 per policyholder growing over time. By the way, all the carriers below offer products to independent insurance professionals. (Note: Advisors who want to run their own comparisons can go here: https://www.ltcipartners.com/generate-a-quote)

| Premiums for Single Female | Premiums for Single Male | Combined Premium for Couple (includes couples discount) | |

|---|---|---|---|

| Carrier A | $4,385.93 | $2,501.91 | $5,929.00 |

| Carrier B | $3,857.66 | $2,152.93 | $6,011.00 |

| Carrier C | $2,764.00 | $1,800.00 | $2,764.00 |

| Carrier D | $3,810.24 | $2,222.24 | $4,826.00 |

| Carrier E | $4,662.10 | $3,059.46 | $5,405.00 |

What benefits do you get for those premiums? At age 85 (28 years after purchase) when many claims occur, these policyholders will get a monthly benefit of about $10,000 per month and a total benefit pool of $500,000 (or $1,000,000 for a couple) payable for home assisted living or nursing care. As you can see, LTC Insurance still provides substantial leverage per premium dollar.

Hybrid Life + LTCI

Long-Term Care Insurance is such a valuable way to prepare for an extended health care event that many Permanent Life Insurance policies include a rider that allows the policyholder to spend down his or her death benefit to pay for Long-Term Care. These riders may be included on a Life Insurance policy without an additional charge (although not always), and benefits will stop when they reach the amount of the death benefit.

While this might be enough for some people, a Hybrid Life + LTCI policy has some more powerful benefits that deserve consideration.

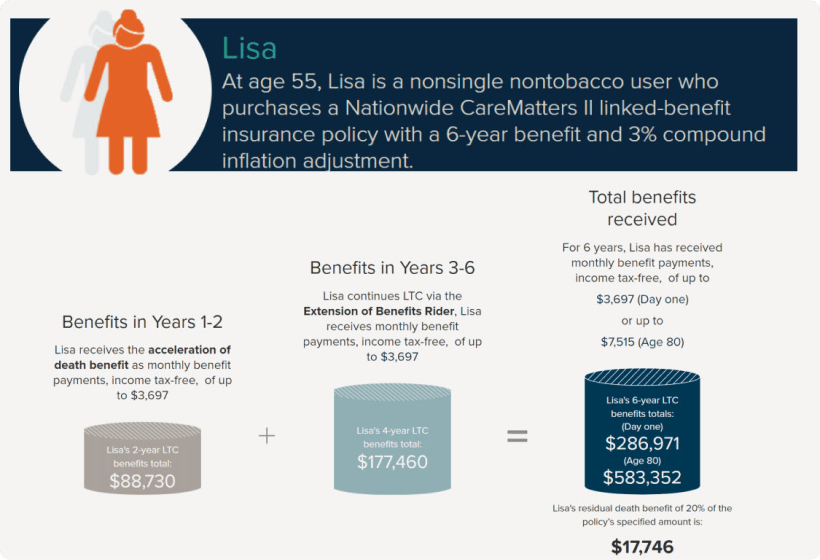

Many consumers hesitate to buy a Traditional LTCI policy because they don’t want to pay for something they hope to never need. Hybrid Life + LTCI policies allow them to plan for Long-Term Care so they don’t have to worry about liquidating assets or struggling to do everyday tasks alone. If the day never comes when they need someone to look after them, those premiums will simply pass to their beneficiaries with the death benefit.

Hybrid policies can pay LTC benefits that are many times more than the death benefit. The policy benefits aren’t taxed, and inflation riders protect policies from losing value to the rising cost of care and inflation. Should the client decide to surrender his or her policy within certain terms, some policies may include riders that promise to return all or a portion of premiums paid. Policyholders can feel confident that they have coverage if they need it, but they can get their premiums back if they don’t.

The graphic below shows how the linked benefit policy works.

Meet HENRY

Many consumers who have large earnings but haven’t acquired significant wealth should consider how they’ll pay for care if they need it. These “HENRYs” (High Earners, Not Rich Yet) may be forced to use savings and other assets to meet financial obligations instead of paying for care. They may simply be accustomed to a certain lifestyle, and unwilling to move out of their homes to receive care.

If you are among these financial up-and-comers, consider how your day-to-day life might change if you aren’t able to work. Do you have enough saved to cover the additional cost of care, as well as your regular expenses?

The ability to pay Hybrid Life + LTCI policy premiums on an ongoing basis instead of in a large lump sum makes it a good option for people who are on their way to being wealthy.

There are several carriers offering LTC + Life Insurance plans, so comparing all the options is important.

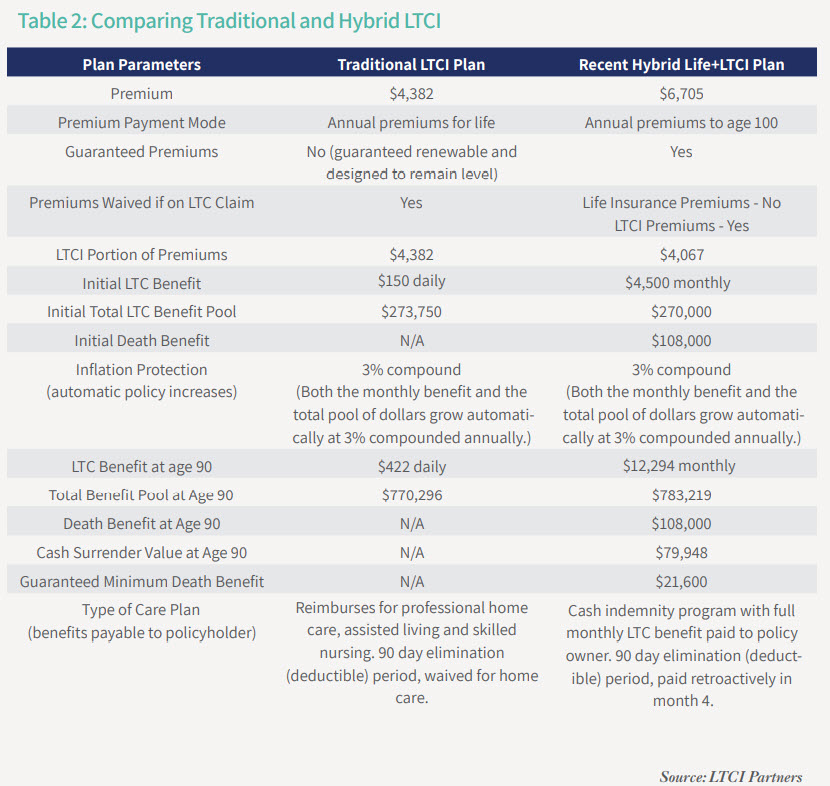

Comparing Traditional and Hybrid LTCI

There are more similarities than differences between Traditional and LTC + Life Insurance Hybrid policies. Here are some of the most important features of both types of plans:

- Will pay for care at home, assisted living facilities and nursing homes

- Offer benefits that are received tax free with similar definitions of what qualifies for claim

- Include riders to increase the benefit over time with inflation coverage

Here's a comparison of a traditional and Hybrid LTCI Plan with similar benefits:

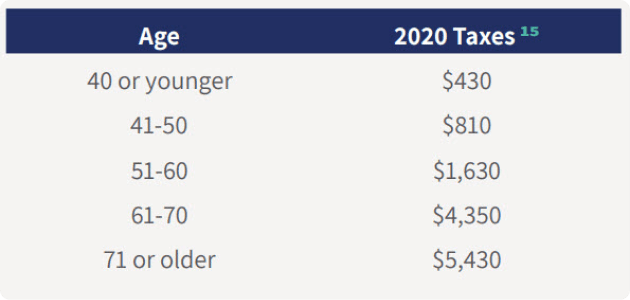

Tax Treatment of LTC Insurance

Consumers are slightly less eager to think about taxes than they are to ponder losing their independence. The good news is that Long-Term Care Insurance has some tax benefits, so people who plan ahead for this kind of care can get some tax relief, too.

Deductions for Premiums

Generally speaking, premiums for Traditional LTCI are deductible to certain limits. It depends on the policyholder’s age and income, as well as the policy specifics.

The IRS allows taxpayers to include insurance premiums on policies that cover medical expenses when itemizing deductions. That includes LTCI premiums, but there are some caveats.

Premiums must be guaranteed renewable, and any refunds or dividends must only be used to reduce future premiums or increase future benefits. If the contract provides a cash surrender value or if the kind of care received would be covered by Medicare, it’s not eligible to be included in itemized deductions. Furthermore, the policy can only cover Long-Term Care services. That means people with linked-benefits or Hybrid Life + LTCI policies can only deduct the portion of the premium that covers Long-Term Care.

Taxpayers who itemize deductions can only deduct medical expenses they paid that exceed 7.5% of their adjusted gross income. It might be harder for very wealthy people to meet that threshold, but the IRS allows them to include expenses paid for actual care, as well as expenses paid for premiums as outlined in the table below.

Premium Deductions Limits

The following table shows the portion of a premium that can be included in medical expenses, based on the policyholder’s age.

Making the LTCI Decision

The decision to purchase Long-Term Care Insurance is not easy— it’s a personal one, based on how much risk you’re willing to tolerate, and the resources you can reasonably rely on if you need care. To help make that decision, here are some things to consider:

- What’s your health status? The ability to obtain an LTCI policy in addition to its price is determined based on the insured’s age and health when they buy the policy. Most people need care for between one and three years, and women typically need care for longer periods than men. It’s hard to project future health needs, but consumers can get better prices when buying policies at younger ages, and when they are in better health.

- Where will you retire? LTCI policies allow you to customize daily benefit amounts, which can be structured around the average cost of care where you live. If you think you’ll live in a different state later in life, whether to be closer to family or just to try somewhere new in retirement, consider how that might affect what you pay for care.

- Are you a business owner? As we’ve already seen, there are some tax benefits to purchasing Long-Term Care Insurance. These benefits are even more pronounced for business owners. Sole proprietors, partners, and shareholders who own more than 2% of an S corporation can write off the cost of LTCI policies paid on behalf of themselves, spouses, dependents, and children younger than 27. The amount that can be deducted is subject to the same age-based cap seen the table above.

- What family and social support system will you have? Some people may hope to turn to children, siblings, or friends if they need help with certain functions. Consider how much you can reasonably rely on those people. When the time comes, they may be providing care for someone else or need care of their own. Some policies may provide benefits that allow you to pay these informal caregivers, which can help ease the burden on loved ones.

- Have you ever been a caregiver yourself? People who have seen first-hand what caregiving entails know how scary it can be. Losing their independence is an emotional burden that many people are unprepared for, but having to turn to unqualified or underqualified caregivers makes it that much worse. Having a ever need care can help people feel in control and assure them that they will be in the best hands at the time they need it most.

Funding Strategies for LTCI

Some policies require a single premium payment that could be tens of thousands of dollars. Even without single premium policies, people who are close to retirement, or who have already retired, may wonder how they will pay the premiums, especially if they remember the rate increases associated with early iterations of the product.

As we’ve seen, carriers have a much clearer idea of how to price LTCI policies, but there are some tools to help consumers pay premiums, especially after they stop working.

- HSAs. Health Savings Accounts are a powerful tool in funding an LTCI policy. The owner doesn’t have to pay taxes on the money they put in the account, the interest earned in the account, or the funds that are distributed from the account and used on qualified expenses. In 2020, people who are enrolled in a qualified High-Deductible Health Plan can use an HSA to save or invest up to $3,550 as an individual or $7,100 for family coverage, and these limits increase every year. People 55 and older can contribute an additional $1,000 in a “catch-up contribution. Because HSA owners aren’t required to exhaust the account every year, they can start saving long before they ever need care. The funds in the account can be used to pay for care— and to pay for LTCI premiums, up to the age-based limits listed in the tax table.

- IRAs. People who have an individual retirement account can convert it into a tax-qualified annuity, which can then be used to make payments to an insurance carrier without incurring tax penalties on the withdrawals. After age 59½, consumers can withdraw as much as they want from their individual retirement accounts without a penalty, and only pay the income tax on the withdrawal.

- 1035 exchanges. The IRS allows taxpayers to make a tax-free transfer of an existing Annuity, Life Insurance policy, or LTCI policy to a product of a similar kind, with the same ownership. In most cases, Long-Term Care benefits aren’t taxable, making this strategy an effective way to fund an LTCI policy tax-free.

Simplifying the Sales Process

Underwriting Assistance

Before issuing an LTCI policy, carriers will conduct a health screen to look for people who are likely to have a health crisis or cognitive disability in the near future. As much as 40% of people may be turned down for coverage due to underwriting.

The right underwriting partner can reduce the chance of a client being denied coverage by providing prescreening surveys or consultations to identify potential risks before submitting an application. These screens can be completed entirely online to simplify the process for agents and their clients.

In fact, for many policy buyers, LTCI can be purchased without having laboratory tests or a nurse visit their homes. In addition, applications are electronic, and no paper applications will have to be submitted. Business and underwriting is conducted over the telephone.

Getting Approved

Many carriers offer online applications, but getting approved can still take several weeks. The carrier may require a phone or in-person interview to identify potential health problems, and will request medical records before issuing coverage.

Experienced LTCI specialists can help agents find carriers that are most likely to issue the right kind of coverage for their clients. Some partners can even take the application and get clients’ signature(s) for them; agents just have to be licensed in the state where the client is applying for coverage, and be contracted with the carrier.

Finding an LTCI Partner

Agents can go through an external carrier wholesaler or work directly with carriers to find coverage for their clients, with benefits and drawbacks to each strategy.

Sometimes agents or financial advisors have clients they know would benefit from Long-Term Care Insurance, but don’t have the expertise to find the right coverage for them.

Some specialists, like LTCI Partners, offer assisted sales services that bring an LTCI expert into the conversation with clients to go over a proposal and answer any questions. The right partner can develop a proposal, support the agent in client conversations, and manage the application process, allowing agents to focus on servicing the client relationship.

Referral to an LTCI Planning Specialist

Purchasing a complex product like LTCI can be overwhelming for consumers, especially considering the emotional burden associated with planning for a time when their well-being will be in the hands of another person. Agents can overcome the emotional objection by developing a referral pipeline among current customers.

LTCI owners are highly satisfied with their coverage. Agents should use follow-up and review meetings as opportunities to ask for introductions.

Employers are increasingly offering Long-Term Care Insurance as part of their voluntary benefits packages, and some are even paying for part of it or extending coverage to family members. This is a valuable resource for agents who are still developing their referral network.

Looking Ahead

Not all of us will need LTCI in our old age, but we will all need care of some kind. As we live longer lives and traditional family support systems are less common, it’s critical that we take the time now to envision our lives in the future. Long-Term Care Insurance can play an important role in our plan to achieve that vision.